|

Message from the Chairperson

Julie A. Buschman, CPA, AEP®

Dear Fellow Designees:

There has been a great deal happening within the Accredited Estate Planner®

Designation Oversight Committee in recent months and I am excited to share a

recap of those activities with you today!

First, a sub-committee under the leadership of William D. Kirchick, Esq.,

AEP® has been hard at work for many months reviewing not only the application to

become a designee, but the qualifications and requirements to do so. As you can

imagine, this has been a lengthy process that has been approached with great

care. I am pleased to report that as a result of these efforts, the designation

is now available to credentialed professionals in the following disciplines—accounting (CPA); insurance and financial planning (CLU®, ChFC®, CFP®, CPWA®,

CFA); legal (JD); philanthropy (CAP®, CSPG); and trust services (CTFA)—who

are devoting at least a third of their professional time to estate planning and

meet all of the remaining program requirements. Please take a moment to think

about your colleagues that may have one of these credentials and meets the

professional requirements of an AEP®. Your referral is valuable.

The committee has also been taking a careful look at the benefits that the

nearly 2,000 AEP® designees have access to. Our goal for 2017 is to provide

additional AEP®-only benefits and we would love to hear from you! Please take a

moment to share benefits that may be on your "wish list" with our committee by

emailing admin@naepc.org. Your input is valuable and appreciated.

Finally, the committee will soon begin its work to select the next class of

entrants into the NAEPC Estate Planning Hall of Fame®! We are so excited to be

welcoming the following individuals on November 17th during the

54th Annual

NAEPC Advanced Estate Planning Strategies Conference and hope you will be with

us to celebrate their wonderful achievement: Vincent M. D'Addona, CLU®, ChFC®,

RICP®, RFC, CExP™, MSFS, Donald O. Jansen, JD, LL.M., R. Hugh Magill, JD, Edward

Mendlowitz, CPA, Joshua S. Rubenstein, JD and John J. Scroggin, JD, LL.M.,

(taxation). Please read on within this newsletter to learn more about the annual

conference.

In closing, I wish you wonderful spring days ahead and hope to have an

opportunity to meet you in person in November at the Annual Conference in New

Orleans!

Best wishes,

Member Benefits,

Programs & Services

NAEPC strives to offer AEP® designees high-quality benefits, programs and

services at value pricing. We continually look for opportunities that will

enhance the value of your membership and make your practice more efficient.

We are very proud to make the following benefits available to you, our

Accredited Estate Planner® designees, at reduced prices or substantial

discounts. A brief description of each product or program can be found online in

the member benefits section of our website, along with pricing and ordering

information. Some of the resources are even complimentary—take a look today! Be

aware, however, that your password may be required to view some of the

information. Please use the "I forgot my password option" if necessary.

New Benefits

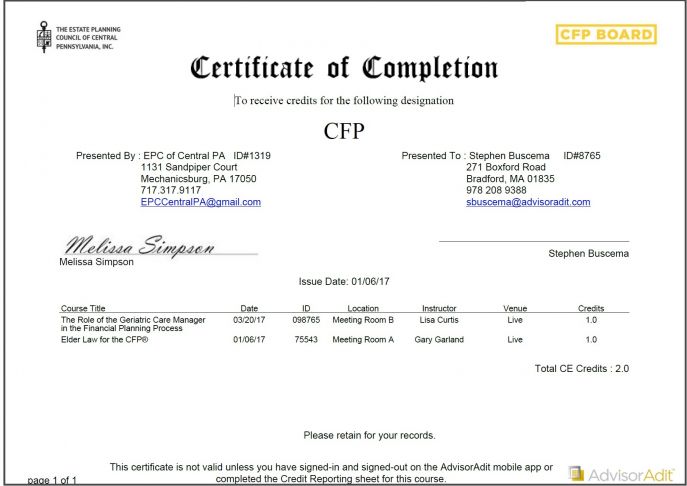

AdvisorAdit - Mobile Event Services for Councils AdvisorAdit - Mobile Event Services for Councils

DIGITAL CONFERENCE BOOK - COURSE SURVEYS - ATTENDANCE TRACKING

Introducing New NAEPC Program: 50% off standard rates and a free trial!

Our suite of mobile event services is a cost-effective way to modernize your

attendee experience.

With AdvisorAdit's suite of digital event services EPCs enjoy:

- An intuitive attendee experience...available on any leading mobile device

- Simple event set up and real time host monitoring, updating and

reporting

- Flexibility to use only the services that are right for your event

- Special NAEPC pricing scaled to support small meetings to large expos

Our suite of digital event services... select the ones for you!

- Digital Conference Book: For less than the cost of printing, you

can offer attendees access to a fully branded app delivering all

conference-related handouts. Consider enabling sponsors to add their own

content. This is a fantastic way to "Go Green"!

- Surveys: Dramatically increase attendee feedback with integrated

course level surveys! Use our standard survey or create your own. Hosts can

instantly share results with speakers and colleagues.

- Attendance/CE Tracking: Stop collecting CE forms and wasting time

and money on manual reporting! Members can apply for CEs (up to 7

designations) and even update their credentials. Hosts have full

transparency and control with real time reports.

- Certificates: Delight attendees with instant access to

designation level certificates! With extended certificate access, you can

even create your chapter's own "My CE" page on their website.

See complete information about

AdvisorAdit..

.jpg) AICPA

Engage - June 12-15,2017 - MGM Grand Las Vegas, NV | Online Broadcast AICPA

Engage - June 12-15,2017 - MGM Grand Las Vegas, NV | Online Broadcast

The AICPA Advanced Estate Planning and Personal Financial Planning

Conferences join AICPA ENGAGE this June. Experience four days of fresh ideas and

breakthrough presentations—all under one roof.

Bring the greatest value to your clients by becoming the most trusted

resource for navigating shifts and changes in the global economy. Immersed in

four days of leading-edge best practices and ideas from esteemed thought leaders

in financial planning and estate planning, you'll learn why past attendees rave

about this conference every year.

Choose among five tracks for focused learning: Insurance and Risk Management,

Investment Management, Practice Management and Technology, Wealth Management and

Tax, and Retirement Planning. You'll refine business strategies, implement new

techniques, and learn a holistic approach to every life stage affecting your

client's financial outlook.

Learn more and register. NAEPC members are entitled to take advantage of a

$100 discount by using code "100ENG17" at checkout.

M Brands Film, Inc. (M)

Watch the M welcome video. Watch the M welcome video.

Do you have website video? If not, you are turning away 90% of your prospects

and clients. Video connects you to pain points, education, support, and

retention throughout their wealth preservation journey.

Through a value partner arrangement with NAEPC, M is offering video production

services at a 20% discount to members. Through the web, M creates explainer

video for your website, social media, and communications. In 45 minutes, M makes

the shyest professional shine with sincerity without breaking your budget,

interrupting operations, or making a cartoon out of your business. Plus, we

offer your clients legacy videos for their loved ones. With 3,000 videos on mbrands.co, we're ready to shoot yours. Ping M

(loyalty@mbrands.co)

or ring (415.404.9276) to set up a free video assessment of your website and

important estate work.

Learn more about the M process.

54th Annual NAEPC

Advanced Estate Planning Strategies Conference

Topics

and Speakers have been announced! Topics

and Speakers have been announced!

Registration is open!

The only thing left to do? Register to attend!

Please plan on joining us this November 15-17 for the best 2-day estate

planning program in the country! AEP® designees can take advantage of an

additional $50 discount, which can be combined with the $50 early bird

discount, making this a very economical investment of both your time and

resources! The registration fee includes most meals, two full days of national

and multi-disciplinary continuing education credit and attendance satisfies one

full year of your AEP® designation CE requirement.

Here's what you will experience in New Orleans:

Thursday,

November 16, 2017

|

Sponsor Bonus Session: Life Insurance in Estate Planning: Beyond the Role of

Benefits for Beneficiaries & Tax Strategies

Darwin M. Bayston, CFA

Session provided by Berkshire Settlements, Inc.

Modern Uses of Partnerships in Estate Planning

Paul S. Lee, JD, LL.M. (taxation), AEP® (Distinguished)

Sponsored General Session: Advanced Planning Applications for

Market-Based Life Insurance Valuations

William Clark, Jamie Mendelsohn & Jon B. Mendelsohn

Session provided by Ashar Group / Ashar SMV

How Slippage and Gray Areas Lead Us Into Ethical Lapses

Marianne M. Jennings, JD

Minimizing Family Conflicts in Estate Planning

John J. Scroggin, JD, LL.M., (taxation), AEP® (Distinguished) Nominee

|

|

Product Selection and Design: Which Type of Product to Use in Common Estate

and Financial Planning Scenarios and How to Design and Fund It

Charles L. Ratner, JD, CLU®, ChFC®, AEP® (Distinguished)

Current Issues in Estate and Gift Tax Audits and Litigation

John W. Porter, B.B.A., JD, AEP® (Distinguished)

Special Sessions on Thursday, November 17, 2016, 5:15 pm

Annual Private Event for Active Accredited Estate Planner® Designees and

Estate Planning Law Specialist Certificants

A Discussion with Turney P. Berry, JD, AEP® (Distinguished)

|

Friday, November 17, 2017

Tax-Efficient Drawdown Strategies During Retirement

Robert S. Keebler, CPA/PFS, MST, AEP® (Distinguished), CGMA

Estate Planning Current Developments and Hot Topics

Steve R. Akers, JD, AEP® (Distinguished)

Sponsored General Session: Understanding Asset Protection in the 21st Century

Douglass S. Lodmell, JD, LL.M.

Session provided by Asset Protection Council® / Lodmell & Lodmell, P.C. |

|

The Use of Non-Grantor Trusts for State Income Tax Minimization

William D. Lipkind, JD, LL.M.

Planning for Privacy in a Public World: The Ethics and Mechanics of

Protecting your Client's Privacy and Personal Security

John Bergner, JD & Jeff Chadwick, JD

Subchapter J - Income Taxation of Trusts & Estates

Mickey R. Davis, JD & Melissa J. Willms, JD, LL.M.

|

To learn more, download the

"early bird" registration brochure

or register online!

We are grateful for the support of all conference sponsors and exhibitors,

including:

Berkshire

Settlements, Inc.

Alliance Trust

Company of Nevada

International Wealth Tax Advisors

Life Insurance Settlements Inc.

National Guardian Life Insurance

Company

The Technical Corner

This month we are pleased to provide you with:

IRS Sheds Light on Estate Tax Lien Discharge Process: Interim Guidance for

Responsibility to Process all Requests for Discharge of the Estate Tax Lien

John T. Midgett, JD, AEP®

We would also like to highlight the

NAEPC Journal of Estate & Tax Planning, and the most recent issue's

Accredited Estate Planner® Designee Top Pick.

Estate Planning Traps

That Have Nothing To Do With Estate Taxes

A NAEPC Journal original! At a time when some clients may be wondering why

they should proceed with estate planning due to the proposed elimination of

the estate tax, this article reminds us that there are many issues to

resolve aside from taxes and provides wise counsel on how to proceed.

Authors: Stuart M. Horwitz, JD, LLM (Taxation) and Jason S. Damicone, JD,

LLM (Taxation)

Congratulations, Stuart and Jason, on receiving the December 2016 AEP® Top

Pick!

Subscription Options

You are receiving this message because you are an active Accredited Estate

Planner® designee in good standing.

If you want to receive more frequent and timely communication about

the NAEPC and its educational programming and member benefits,

please be sure to subscribe here.

National Association of Estate

Planners & Councils 1120 Chester Avenue, Suite 470

Cleveland, OH 44114

Phone: (866) 226-2224 ~ Fax: (216)

696-2582 ~ E-Mail:

admin@naepc.org

©

2017, All Rights Reserved.

See Privacy Policy.

{VR_SOCIAL_SHARING} |