July, 2015 Newsletter

Provided by Leimberg Information Services

See other issues.

Lee Slavutin & Practical Guidance for ILIT Trustees and Their Advisors

“This newsletter summarizes four cases where the beneficiary of an ILIT sued the trustee for alleged violation of his fiduciary responsibility. The cases are analyzed within the context of the Uniform Prudent Investors Act (UPIA). In two cases, Cochran v. KeyBank and French v. Wachovia, the trustee was vindicated and, interestingly, in both cases the trustee relied on an independent third party to evaluate the insurance proposal. In the other two cases, Paradee v. Paradee and Rafert v. Meyer, the trustee behaved recklessly and taught us what not to do. This newsletter aims to provide trustees and their advisors with practical tips to ensure that they fulfill their responsibilities when dealing with life insurance trusts.”

Lee Slavutin’s commentary summarizes four cases where the beneficiary of an ILIT sued the trustee for alleged violation of his fiduciary responsibility, and aims to provide trustees and their advisors with practical tips to ensure that they fulfill their responsibilities when dealing with life insurance trusts.

Lee Slavutin, MD, CLU, a frequent contributor to LISI, is principal of Stern Slavutin-2, Inc., a New York firm specializing in insurance and estate planning. Lee is a nationally recognized expert in life insurance planning. Lee is a member of the Association of Advanced Life Underwriters (AALU) and the Million Dollar Round Table. He has written over 150 articles on insurance and estate planning for Commerce Clearing House, Warren Gorham and Lamont, Thomson Reuters Tax & Accounting, New York Law Journal, and others. Lee is the author of PPC’s INSURANCE STRATEGIES-16th Edition which Steve Leimberg reviewed in Estate Planning Newsletter #2288.To order or for more information on PPC’S GUIDE TO LIFE INSURANCE STRATEGIES call 800 431 9025 or go to http://store.tax.thomsonreuters.com/accounting/Tax/PPCs-Guide-to-Life-Insurance-Strategies/p/100200246

Here is Lee’s commentary:

EXECUTIVE SUMMARY:

This newsletter summarizes four cases where the beneficiary of an ILIT sued the trustee for alleged violation of his fiduciary responsibility. The cases are analyzed within the context of the Uniform Prudent Investors Act (UPIA). In two cases, Cochran v. KeyBank and French v. Wachovia, the trustee was vindicated and, interestingly, in both cases the trustee relied on an independent third party to evaluate the insurance proposal. In the other two cases, Paradee v. Paradee and Rafert v. Meyer, the trustee behaved recklessly and taught us what not to do. This newsletter aims to provide trustees and their advisors with practical tips to ensure that they fulfill their responsibilities when dealing with life insurance trusts.

FACTS:

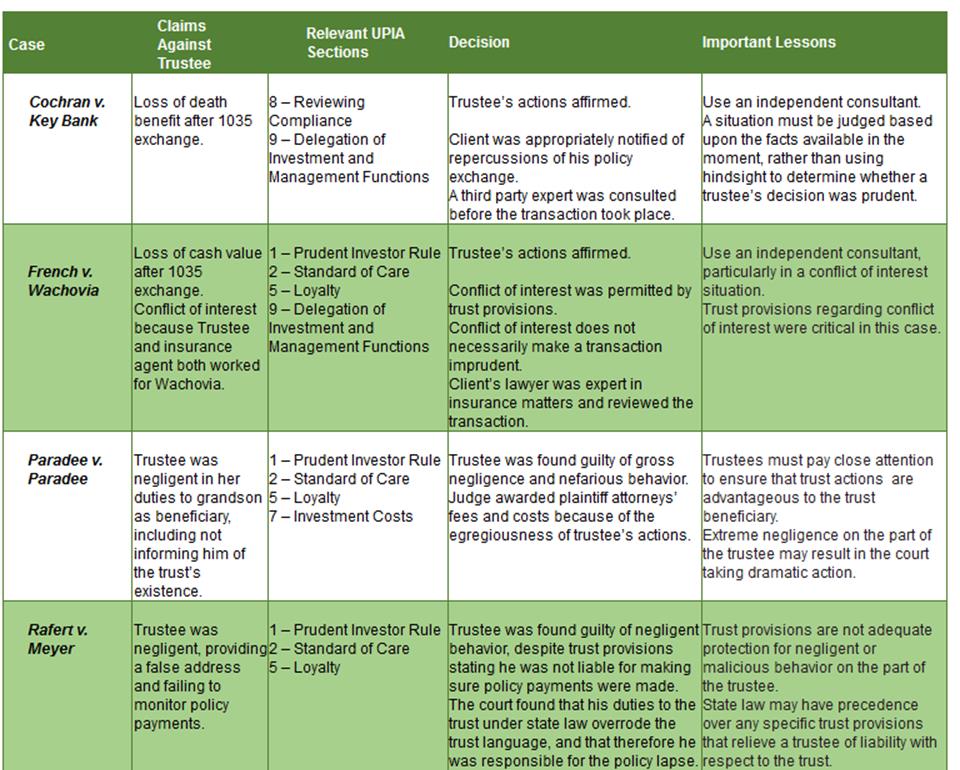

The chart below describes each of the four cases which have provided important decisions regarding trustee administration of life insurance trusts. The cases are described in terms of the complaint(s) filed, the relevant Uniform Prudent Investor Act (UPIA) sections, the decision, and lessons for other trustees and trust advisors. The details of the UPIA are described in detail in the second chart below.

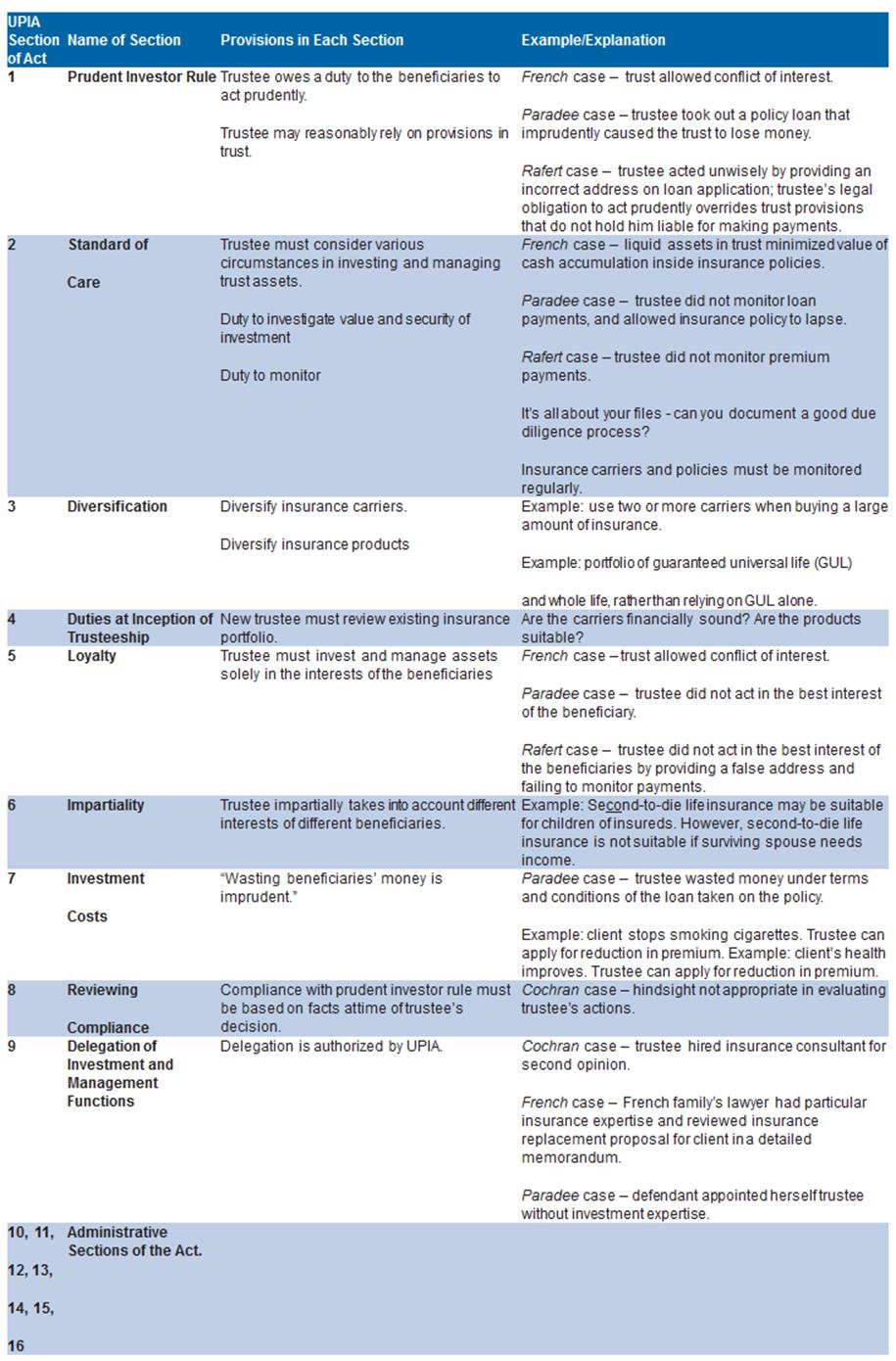

The following chart summarizes each of the nine major sections of the Uniform Prudent Investor Act (UPIA), with examples and/or applicable case(s) referenced where appropriate. The other seven sections of the UPIA are administrative provisions and not relevant to the court decisions described above. Although not federal law, the UPIA provisions have been adopted (with some modifications) by 41 states and the District of Columbia, and are considered the standard in legal guidance for a trustee’s management and operation of a life insurance trust. For a closer look at the Uniform Prudent Investor Act, see LISI Estate Planning Newsletters #2160 and #2163.

French v. Wachovia Bank is summarized by Steve Leimberg in Estate Planning Newsletter #2117:

Jim French’s company built component parts for small engines and later sold this manufacturing business for over $200,000,000. As part of his estate plan, French created irrevocable trusts to benefit his four children upon his death.

In 2004 he moved the trust accounts to Wachovia Bank, N.A.

Among the underperforming investments in the trust portfolio were two whole life insurance policies. After months of evaluation and consultation with French and his lawyers, Wachovia replaced the old policies with new ones providing the same death benefit for significantly lower premiums. French’s lawyer was an expert in insurance matters and wrote a detailed memorandum outlining the advantages and disadvantages of the new guaranteed universal life policy. In this case the loss of cash value with the new product was not important to the trust beneficiaries for two reasons – the trust had substantial non-insurance assets and the beneficiaries had substantial personal assets.

This transaction yielded a hefty but industry-standard commission for Wachovia's insurance-brokerage affiliate.

French’s adult children, the trust’s beneficiaries, were shocked at the size of the commission and sued Wachovia for breach of fiduciary duty. Their primary claim alleged self-dealing. The French children contended that Wachovia breached its duty of loyalty by reinvesting trust assets through its insurance affiliate, resulting in a large commission.

The District Court had rejected this claim on the basis of an express conflict-of-interest waiver in the trust document (the trust instrument specifically gave Wachovia broad discretion to invest trust property without regard to conflicts of interest, risk, lack of diversification, or unproductivity) and also concluded that the transaction was neither imprudent nor undertaken in bad faith. That court entered summary judgment for Wachovia and ordered the plaintiff beneficiaries personally to pay the bank's costs and attorney's fees.

Cochran v. Keybank is summarized concisely by Barry Flagg and Patti Spencer in Estate Planning Newsletter #1499:

In the case of In re Stuart Cochran Irrevocable Trust, ILIT trust beneficiaries sued KeyBank N.A. as trustee, alleging violations of Indiana's version of the UPIA and breach of trust. In the case, beneficiaries challenged the trustee's replacement of two variable universal life insurance policies providing $8,000,000 in death benefits with a $2,536,000 guaranteed universal life policy shortly before the unexpected death of the insured at age 53.

The trustee had retained an independent insurance consultant to evaluate the insurance replacement transaction and he pointed out the pros and cons of the new policy.

Paradee v. Paradee is summarized by Paul Hood in Estate Planning Newsletter #1749, excerpted below:

Charles Sr. married [second wife] wife Eleanor, who was 17 years younger than him, [and they] created a Gallo trust for the benefit of Charles III [Charles Sr.’s grandson]. Three years after creating the trust, Charles Sr. and Eleanor asked the trustee to revoke the trust and to receive the cash value of the life insurance policy “due to unforeseen circumstances,” which the trustee refused to do.

However, when asked whether he could lend cash value to Charles Sr. and Eleanor, …the trustee sought outside counsel about the loan. Despite his lawyer’s written advice, the trustee/life insurance agent made a loan against the policy at 8.75%, yet he made an unsecured loan that paid interest at 8%.

In 1998, Eleanor…requested that the policy be surrendered, the policy loan paid off and the trust principal reinvested. The trustee declined to do this. The following year, Charles III…had a right to become trustee, but the trustee [didn’t] tell Charles III either about his right to become trustee, or, indeed, even the existence of the trust.

During 2003, the original trustee died, and…Eleanor appoint[ed] herself as successor trustee. Beginning in 2003, no further interest payments on the trust loan were made, and the interest was capitalized thereafter. Indeed, Eleanor ignored her lawyer’s repeated advice that Eleanor had a duty to (a) advise Charles III about the trust’s existence, (b) pay Charles III the trust’s income and (c) maintain the policy.

In 2005…the policy lapsed. [In 2009, a successor trustee finally informed] Charles III of the trust’s existence. Charles III promptly exercised his right to become trustee and demanded that the trust loan…be repaid.

The court found that Eleanor had knowingly aided and abetted the original trustee…in breaching his fiduciary duties to the trust…Moreover, the court expressly found that Eleanor knowingly participated in the breach on her own, finding that she repeatedly attempted to revoke the trust and took advantage of the original trustee’s primary loyalty to Charles Sr. and to her. The court also expressly found that Eleanor further breached her duty to Charles III in her capacity as trustee from 2003 to 2005.

The court determined further that the successor trustee also was liable with Eleanor for a portion of the damages to the trust. The court also awarded Charles III damages in the amount of the income that he should have received from the trust…He further awarded attorney’s fees and costs against Eleanor to the successful plaintiffs.

Last but not least, Rafert v. Meyer is summarized by Howard Zaritsky in Estate Planning Newsletter #2286, excerpted below:

The grantor, Jlee Rafert, hired an attorney, Robert J. Meyer, to create and serve as trustee of an irrevocable life insurance trust. The trust corpus was three insurance policies on the Ms. Rafert’s life, issued in the total amount of $8.5 million…for the benefit of Ms. Rafert's four daughters.

Meyer did not meet with Rafert to explain the provisions of the trust or who would be responsible for monitoring the insurance policies owned by the trust. The trust instrument stated expressly that the trustee had no duty to pay the insurance premiums, had no duty to notify the beneficiaries of nonpayment of such premiums, and had no liability for any nonpayment. On each [policy] application, the trustee gave the insurer a false address in South Dakota[, though he] actually resided in Nebraska.

The initial premiums were paid in 2009, but in 2010, the policies lapsed for nonpayment of the premiums. Ms. Rafert, the trustee and the beneficiaries received no notice from the insurers of the lapse until August 2012, because several notices about the forthcoming lapse were sent to the false address provided by the trustee. Ms. Rafert paid $252,841.03 to an insurance agent who did not forward the payment to the insurers (also for reasons not disclosed in the opinion).

Ms. Rafert and her daughters sued the trustee for breach of fiduciary duties, and the trial court granted the trustee’s motion to dismiss for failure to state a valid claim. The Nebraska Supreme Court (Justice Wright) reversed and remanded the case to the trial court for a full trial on the merits. The Supreme Court agreed with the plaintiffs that the trustee had breached his fiduciary duties under the Nebraska Uniform Trust Code and common law, to act in good faith and in the best interest of the beneficiaries, and it denied the efficacy of the trust’s attempt to waive these duties.

The Court held that the plaintiffs had stated a plausible claim against the trustee on which relief could be granted. In general, the Court explained, a trustee’s authority is governed by both common law and the statutes pertaining to trusts and trustees, as well as the trust instrument itself. Among the trustee’s duties is the responsibility to inform the beneficiaries fully of all material facts so that the beneficiaries can protect their own interests where necessary, and the duties of undivided loyalty and good faith, such that all acts of the trustee must be in the best interests of the beneficiaries.

The Court agreed that the trustee breached his duties as trustee by providing a false address to the insurers, failing to keep the beneficiaries informed of the facts necessary to protect their interests, failing to furnish annual statements, failing to communicate the terms of the trust to the grantor, and failing to act in good faith and in accordance with the terms and purposes of the trust and in the interests of the beneficiaries. The Court explained that the trustee and drafter could not waive the duty to keep the beneficiaries reasonably informed of the material facts necessary for them to protect their interests. The Court also found untenable the trustee’s argument that the instrument expressly limited his liability for any claims related to the nonpayment of premiums.

COMMENT:

We can learn a number of valuable lessons from these four cases:

1. A trustee has a primary responsibility to protect the interests of the trust beneficiaries and cannot use an exculpation clause as an excuse for reckless mismanagement (UPIA Sections 1, 2 and 9 and the Rafert case).

2. A trustee has a duty to monitor and manage trust assets (UPIA Section 2) – life insurance is an asset that must be continuously monitored. This includes premium payments (Rafert), loan interest payments (Paradee), carrier financial strength and policy performance (Paradee). Policies in an ILIT should be reviewed annually and the review should be carefully documented in an email or letter to the trustee from the insurance broker or consultant.

3. Although loyalty to the beneficiaries is paramount (UPIA Section 5), a conflict of interest may be allowed if the trust permits it and the conflict is properly disclosed (French). This does not mean that we encourage it!

4. A trustee may only incur costs that are appropriate and reasonable in relation to the assets (UPIA Section 7). Wasting the beneficiaries’ money is imprudent (Paradee).

5. A trustee cannot be criticized on the basis of hindsight (UPIA Section 8 and KeyBank).

6. An ILIT trustee will generally have to rely on an insurance broker or consultant to evaluate insurance carriers, products and policy performance and is permitted to delegate these functions (UPIA Section 9). The trustee will greatly minimize potential liability by retaining an independent expert, especially in large transactions (French, KeyBank). Replacement transactions should be carefully evaluated and the pros and cons should be well documented.

HOPE THIS HELPS YOU HELP OTHERS MAKE A POSITIVE DIFFERENCE!

Lee Slavutin

CITE AS:

LISI Estate Planning Newsletter #2302 (April 15, 2015) at http://www.leimbergservices.com Copyright 2015 Leimberg Information Services, Inc. (LISI). Reproduction in Any Form or Forwarding to Any Person Prohibited – Without Express Permission.

CITES:

Cochran v. KeyBank, N.A., 901 NE 2d 1128, Ind. Ct of Appeals (2009); French v. Wachovia Bank, N.A., 800 F.Supp 2d 975 (2011); French v. Wachovia Bank, N.A., CA-7, Nos. 11-2781 and 11-3437 (2013); Paradee v. Paradee, C.A. No. 4988-VCL (2010); Rafert v. Meyer, 290 Neb. 219, No. S-14-003 (2015); Paradee v. Paradee (C.A. No. 4988-VCL, (Del. Ch. Oct. 5, 2010)).

The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any federal tax penalties. Lee Slavutin is not authorized to give legal or tax advice. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal tax or legal counsel.

All NAEPC-affiliated estate planning councils are eligible to receive a discounted subscription rate to the Leimberg LISI service. Please see more information about the offering. You may also contact your local council office / board member to find out whether they are offering the service as a member benefit.